What are e mandates?

e mandates are useful tools that help automate recurring payments using the NACH architecture created by NPCI. Typically, a corporate organization desirous of collecting automated periodic payments leverages NACH eMandates to register, track & collect these payments.

E mandates are entirely digital, and they can be created, registered, and administered online through an eNACH service provider.

The registration process of an e mandate is straightforward. While some e mandates are still registered manually by submitting a mandate form, the vast majority of e mandates are registered online which is regarded as one of the benefits of e mandate.

During e mandate registration, the following information is collected:

- Personal information consisting of the customer’s name, phone number, and email address.

- Details about the mandate including the mandate variation of choice, the frequency of debits, and if the amount is fixed or variable

- Bank information such as the customer’s personal bank account details

There are several eNach types, often known as mandate variants depending on the mode of mandate registration. Each one offers unique eNACH advantages.

Three Types of e Mandate

Data is collected automatically by the e mandate provider and the user is directed to the NPCI ONMAGS portal in this simple variation of e mandates. The mandate data are then forwarded to the customer’s destination bank for confirmation, and once received, the customer is sent to the destination bank, where they enter their debit card or NetBanking information to authenticate the mandate.

In this variant of e mandates, the mandate is registered after Aadhaar OTP authentication. The consumer initially inputs their registration information on the e mandate provider’s portal and agrees to the linkage of Aadhaar records. The user’s Aadhaar-registered mobile number is subsequently sent an OTP, which is used to authenticate the information provided.

Following authentication, the mandate details are forwarded to NPCI, the customer’s destination bank, and back to the e mandate provider, who displays the Aadhaar mandate status to both the customer and their destination bank.

After putting the esign based e mandate on hold in 2018, NPCI has allowed esign based e mandate for all member banks beginning from June 1, 2020.

Physical mandates entail clients filling out a form with their mandate information. This form is then either manually or scanned at the customer’s destination bank. e mandate service providers use OCR-based document scanning to read information from mandate forms and submit it to the NPCI and the destination bank for verification. Once the details are validated, the mandate is registered which then allows the consumer to understand the benefits of e mandate.

The benefits of e mandate include accelerated payment collection & seamless client experiences. However, most businesses are unaware of how to get the most out of NACH eMandates.

Here are four steps corporate organizations can follow to simplify and expedite their recurring payment collection.

Four Steps For Hassle-Free Periodic Payments

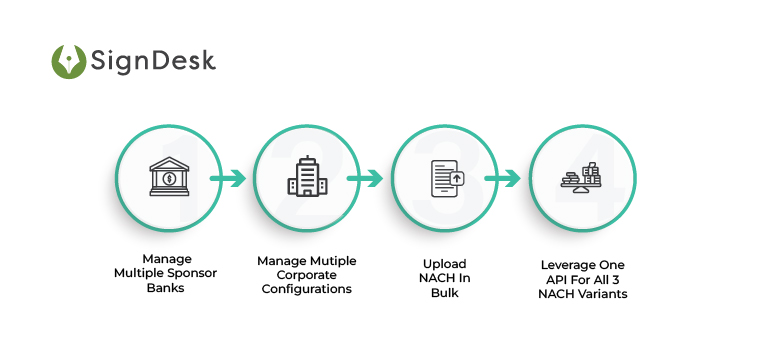

Step 1: Manage Multiple Sponsor Banks

The bank that lodges/initiates NACH Transaction files for the collection or distribution of funds on behalf of its Corporates enrolled for NACH services is known as the Sponsor Bank. In the case of loan EMIs, the bank serves as both the User Institution and the Sponsor Bank.

The decision to sponsor payment facilitators is a balancing of risks and advantages for banks. It enables businesses to target merchant types—particularly smaller merchants—that they might not have supported otherwise, thus extending and broadening their merchant base. It also generates additional money from transaction fees.

Corporate organizations usually collect pending payments through a sponsor bank for due diligence purposes. To better streamline this payment collection process, most corporates rely on multiple sponsor banks. This helps reduce friction in the NACH workflow and ensures that payments go through with no hitches.

When it comes to managing multiple sponsor banks, if the corporate user number or utility code used in the API e mandate is already mapped to the new sponsor bank, the corporate must submit a “Corporate request e mandate-Annexure II” and a “Sponsor bank letter-Annexure III.”

The new sponsor must authenticate the request, with the authorized signatory signing all pages and the bank seal clearly affixed.

If the corporate’s API e mandate user number or utility code is not mapped to the new sponsor bank. “Corporate form – Annexure I,” “Corporate request e mandate – Annexure II,” and “Sponsor bank letter – Annexure III” must be submitted by corporate. The authorized signatories’ signatures and seals should appear on all pages of the documentation.

e mandate payments and transactions that were registered with the previous sponsor bank can be initiated by the new sponsor bank. Such directives, however, will not be subject to change or annulment.

To register or register additional mandates from customers to NPCI, the business organization can use a new sponsor bank.

Step 2: Manage Multiple Corporate Configurations

The modern corporate enterprise is typically a complex entity consisting of multiple organizations & branches. Each of these organizations may have different payment structures and workflows in place.

To streamline payment collection in such cases, corporate organizations can manage multiple configurations to suit their internal needs. eNACH eMandate services offer features to smoothly manage and switch through multiple configurations. Here’s how –

Scenario 1 – Multiple Entities Under One Enterprise:

An enterprise may have two or more different entities under it – multiple business operations in a large firm can be organized as separate companies. E Mandate allows for the procuring of relevant data from these entities and transmits these data to a cloud storage facility that’s available for that particular enterprise.

This helps streamline the recurring payments process across the board. Additionally, any changes may be tested and deployed using API or directly from the common dashboard to ensure business continuity.

Scenario 2 – Two Separate Entities Bridged By An Enterprise:

If there’s a corporate enterprise acting as bridge between different individuals or entities, that entity can use the multiple configurations feature to extract relevant data from their systems to enable the NACH debit system for them.

These data are then re-distributed back to the bridged entities, with real-time data updates sent to them whenever necessary. Most importantly, eNACH can be leveraged to provide a detailed history of transactions for each entity, which helps in organizational due diligence.

Step 3: Upload NACH Mandates In Bulk

With the bulk upload feature, making payments via electronic means is safer, more convenient, and completely secure. By uploading multiple mmandates at once, businesses can experiece faster turnaround times which helps accelerate loans and investment workflows.

The single file upload also helps in the multiple modes of payment. Allowing bulk payments to multiple beneficiaries via a single file upload increases payment efficiency while cutting down the time and effort involved.

The bulk upload feature enables banks to

- Option to pick different payment mechanisms such as Fund Transfer, NEFT, RTGS, and IMPS for payment to multiple beneficiaries in a single upload

- Create customized upload file format, allowing to directly submit accounting software output

- Set up payments at later dates

- Built-in checks to prevent duplicate entries/files

- Simple reconciliation using MIS report

Step 4: Leverage One API For All Three NACH Variants

Hailed as one of the most important features of e mandates, the all-in-one NACH API helps automate periodic payments throughout the organization. Customers can approve demands electronically, eliminating the need for human engagement and logistics.

By integrating with a single API, enterprises can offer clients and merchants the ability to create all three types of Mandates – physical, API-based, and Aadhaar eSign.

The API enables enterprises to scan physical NACH forms with QR code facilities, following which the mandate details are sent to NPCI and the destination bank for verification.

In case of eSign-based NACH, this API enables clients to receive an OTP on their Aadhaar-registered mobiles and use this to quickly approve mandates.

For API e mandates, the workflow is quite evident. API NACH enable enterprises to gather and submit mandate-related data to the NPCI and then to the destination bank from which payments are debited.

The registration process of e mandate using APIs is made easier with the following simple steps:

- The corporate organization requests an eMandate.

- Signdesk gathers the necessary data, which is subsequently transmitted with the NPCI – ONMAGS page.

- After consent, the consumer is offered to view these details, which are then submitted to the target bank.

- The customer enters their Netbanking or debit card information here for verification.

- The bank next decides whether to accept or reject the e mandate.

By integrating with a single API, businesses are able to –

- Register mandates instantly & generate UMRNs

- Automate data submission to NPCI

- Receive system-generated debit sheets

- Automate periodic fund transfers

- Track and manage payments throughout

API e mandate offers the following unique advantages to enterprises:

- Easy to Use –

The difficulties associated with last-minute manual payments are eliminated by automating recurring payments. It also ensures that payments are made as per schedule.

- Reduced TAT –

The complex and time-consuming process of traditional mandate registration takes at least two weeks. TAT is reduced by over 50% using the e mandate API, increasing efficiency and productivity.

- Real-Time Tracking –

APIs deliver precise tracking information on the enterprise dashboard. When clients register for a mandate online, businesses can track the status of registration, approval, and NACH debits.

- Pan-India Presence –

With e mandate, a consumer can make payments from anywhere in the country. They must simply draft the mandate online and either eSign it or approve the details using their bank account or card details. The rest is done automatically.

The banks that have the facility of API e mandates are listed by NPCI. The NPCI e mandate bank list can be found here.

e Mandate: Recurring Payments Made Seamless

SignDesk’s product Link.It provides complete digital solutions for mandate administration, addressing all NPCI versions from registration through fund collection and payment.

Customers can safely authenticate e mandates online using a debit card, NetBanking, or Aadhaar eSign. Every time debit is scheduled, Mandates are further safeguarded with Additional Factor Authentication (AFA).

On the smart dashboard, mandates can be established, registered, updated, tracked, and deleted. Transaction histories, as well as mandatory failure rates, are available, allowing organizations to construct a reliable audit trail for payments.

e mandates enable businesses to digitally scale up their payments, automate efficiently, and substantially reduce operating costs. SignDesk’s API-based e mandates allow for bulk uploads of mandate data and have a 95% success rate.

Our clients have noticed a 50% reduction in TAT thanks to our eNACH e mandate solution, enhancing output and efficiency.

Schedule a free demo now to reap the benefits of e mandate and accelerate regular payments with SignDesk’s leading e mandate solution.